By LUDWIG VON KOOPA - Answers to some common (often bad faith) objections.

By LUDWIG VON KOOPA - Answers to some common (often bad faith) objections.

The start of this calendar year had probably the most press and political attention put on the FAIRtax plan (promoted by Americans for Fair Taxation) in many years, as part of agreements made with the ascension of the House of Representatives speaker Kevin McCarthy. (You may remember him getting memed on for his endless votes to get enough Republican representatives to agree to choose him as the Speaker of the House.) One of the things that certain Republicans wanted was a vote on the FAIRtax, which is in legislation this session as H.R.25 - FairTax Act of 2023.

The FairTax Act calls for a national consumption tax of 23% of new retail sales, which includes both goods and services. That tax will abolish the existing income, business, payroll, capital gains, and estate taxes. It will also abolish the abusive Internal Revenue Service, with states collecting the sales tax from businesses and then remitting it to the Treasury. (And both the state and the business get to keep 0.25% of the money as a thank-you, referred to as a “taxpayer administrative credit”.) The rate is chosen to be “revenue neutral”, which means that it is supposed to theoretically raise the same amount of money as all of the taxes it is replacing. If that means the government ends up in a deficit, that's because it was going to have a deficit anyway due to spending too much. Each qualified family will also get a “family consumption allowance”, also known as a sales tax rebate (it's a “prebate” in that you get the money at the start of the month before you spend it) equal to the monthly poverty level (as already determined by the Department of Health and Human Services) multiplied by the sales tax rate. The prebate will be provided by the Social Security Administration, which are already pretty decent at giving people money they're entitled to.

Over the past several months, I've seen a lot of questions about the FAIRtax plan, as well as a lot of outright lies from the media (including from Semafor, which is the “Project Coda” I mentioned over a year ago as the supposedly unbiased media outlet founded by a former FAKE NEWS Bloomberg CEO—in other words, the guy founded a group just as bad as the group he managed and left, who could've guessed?) and politicians (politicians lying and smearing their opponents? Who could've guessed?!). I'll address some of those questions and lies in this article.

Will the Rich Get Richer and the Poor Get Poorer Under FAIRtax?

Everyone will probably end up richer, which is what you want in an economy. With regards to government involvement, since if you're an American and you just submitted a tax return (this wouldn't be a thing under the FAIRtax, though if you are a business entity that supplies goods and services, you'll have to remit the money you've been collecting in tax from your customers to your state treasury every month), you can figure out your effective tax rate. You can similarly calculate your effective tax rate under the FAIRtax. I walked through an example with someone and their effective FAIRtax rate (it'll be 23% subtracted by the effects of the fixed amount prebate) would be about 1% less, but it depends on how much you make (and how much you plan to spend). Note that you should include payroll taxes in the calculation, and if you really think about it, you should include the employer-side payroll taxes as well, which would pretty much make everyone better off in the FAIRtax. (But with the example I walked through with an American, we only calculated his rate based on the employee-side taxes.)

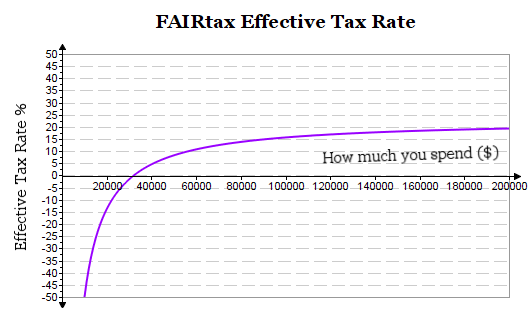

As you can see from the above graph, the FAIRtax is mathematically “progressive”, meaning more wealth spent results in a higher percentage of tax paid. (As well as, obviously, a greater raw amount of tax paid.) If you plan to buy a new yacht, mansion, or TAG HEUER Mario Kart chronograph, you'll have a much higher tax rate than the person just spending money on groceries and medicine. And, remember, you get to keep your whole paycheck (or at least, get to keep the parts that would be chopped off due to federally sourced taxes).

What is Exempted in the FAIRtax?

This is something that I see FAIRtax supporters on Twitter sometimes not seem to understand. What you call “essential goods” are NOT exempted from the tax. That is because the plan creators are concerned about the influence of corporate lobbyists saying that their product should count as essential, and then it's a mess from there. That's how you see Congress declare that pizza is a vegetable. Maybe someone would try to get the Ring Fit Adventure videogame to be considered a medical device.

In that same vein, you get to do whatever you want with the prebate money. It's not like some welfare programmes where the government controls how you get to spend the welfare money. You could spend it on your groceries, your medicine, or not at all and save it. In addition, every household can ask for the prebate. There is no income range or limit. Your employer will still report your wage, not to the IRS, but to the Social Security Administration. That wouldn't be used to calculate your prebate, however. That'd be for how much Social Security benefits you get.

How About the Underground Economy?

First, you need to remember that the FAIRtax is trying to replace an existing system. When comparing the two systems, you need to see if it does something better or worse than the current system. With regards to compliance issues, while compliance won't be at 100%, there are mechanisms that make compliance much easier for the government under the FAIRtax than the current system. For one, the calculations and rules involved are much more simple. The business's report involves how much money they made, how much tax was collected, and any issues like credits claimed (such as getting a refund for overpaying the previous month, or bad debt, or the 0.25% administration fee).

That 0.25% fee is an incentive for businesses and states to collect and transmit the collected taxes. In addition, the legislation describes how the Treasury will establish a toll-free phone number for you to snitch on entities that aren't properly reporting the taxes they collect, which seems like something that a business's competition would want to try using if they figure out that their competitor isn't properly remitting tax. In any case, there are far fewer business targets to audit for the states than individual income tax payers like today, and most retail sales in America go through a consolidated group of behemoths that would get very messed up if they were caught not remitting taxes. (And it'd be fairly easy to figure out, especially for publicly traded companies.) Tax fraud will still be a punishable offence.

What About Retirees?

If you have a retirement plan, those accounts will no longer be taxed when the money is taken out. It'll suck for people with Roth IRAs, though.

How is the FAIRtax Politically Feasible?

Grover Norquist, president of Americans for Tax Reform (he is basically a grifter that stands in the way of actual tax reform, which is what Tax Heaven 3000 had an issue with), went and called me out for the political infeasibility of the FAIRtax plan, especially for the provision at the end that repeals the 16th Amendment (the one that allows Congress to have a federal income tax to begin with). No one besides the late Herman Cain would push for both a federal income tax and a national sales tax co-existing, after all, which is why the plan wants to abolish the 16th Amendment, and if that doesn't happen within seven years of the Fair Tax being enacted, then the Fair Tax will no longer apply and the old system presumably returns.

Name the 2/3 of the US House/Senate that would vote to repeal the 16th amendment that allows an income tax?

— Grover Norquist (@GroverNorquist) January 22, 2023

Name the 3/4 of the states that would have their house & senate both vote to do same?

The Democrats will put the income tax back as soon as they have the congress/prez https://t.co/aTRsUMpNYC

It's not a very imaginative response. If the FAIRtax works in practice as it's theorised to, there would be overwhelming popular support for repealing the 16th Amendment and maintaining the consumption tax that politicians that stand in the way of it would get tossed out of office. Taxes aren't a niche issue, after all. It's something every American taxpayer is involved with and has a stake in, and it ought to come before any other issue. And if Democrats would be the barrier to that (and... the party really should be supporting this plan), less Democrats will be in power.

Is the Rate 23% or 30%?

It's 23% inclusive and 30% exclusive. That means that if you buy a $77 (pre-tax) good, you'd pay $23 in tax for $100 total. $23 is 30% of $77. This is how sales taxes are normally calculated. However, if you look at your $100 total spending for the day, and $77 was on the good and $23 was on the tax, the tax was 23% of your bill. This is how income taxes are normally calculated. When you tell someone your salary (or when a business tells you your salary), they give you the gross amount (before taxes or deductions). A chunk of that is taken out from income tax and payroll tax. Your income tax rate is calculated by how much tax is taken out divided by how much gross pay you got.

Because the FAIRtax is trying to replace an income tax system, Americans for Fair Taxation uses the same inclusive calculation that the income tax does, in order to enable an apples-to-apples comparison. The fact that it's a lower % number to market with is a coincidence(?). What's important is that the $23 in tax is the same either way you calculate it. If you don't like how there are two ways of looking at it, blame percentage change calculations (mathematics), not Americans for Fair Taxation.

Will the 23% Rate Actually Fully Fund the Government?

The consumption tax won't fully fund the government, because its goal is to collect as much revenue as the current system does, and the current system runs large deficits every year. It is designed to fund what the government currently takes in for income taxes, capital gains taxes, payroll taxes, corporate income taxes, and some other categories.

Will the 23% rate actually be revenue neutral? I actually asked Americans for Fair Taxation this question months ago. One of their economists was supposed to get back to me on this, since I said the 23% number has been proposed for over two decades now, and in that time, the federal tax code has changed quite a bit. The nature of what the plan is trying to raise the same amount of money as has changed since the plan's creation. Unfortunately, I never got that economist's reply.

You can't always guarantee that economic projections will actually work that way until they actually happen. But if the tax ends up not making enough money, or making too much money (such as from economic growth making the 23% of a bigger number than expected), then they could always change the number. The great advantage of the FAIRtax is that it is very transparent, much moreso than the current complicated and socially engineered system of marginal rates and deductions. You'll see the rate on any receipt, so you'll KNOW if it has changed.

Will Prices Really Go Up By 30%? I Can't Afford That!

It is unlikely that prices will go up by 30%. The reason for this is that businesses will no longer have to pay taxes, or their supplier's taxes, or that supplier's supplier's taxes. Here is a visual example provided by Americans for Fair Taxation:

REMEMBER: 1. All taxes are paid by individuals; 2. YOU eat the costs for businesses. #FAIRtax is the fix. https://t.co/tQNXLP45qj pic.twitter.com/ahNT09BeeK

— FairTax® Official (@FairTaxOfficial) February 7, 2023

The tax code already makes it so there are layers of embedded taxes. The FAIRtax strips those “hidden” costs (hidden to the customer) and replaces them with a transparent one. You might say that businesses will still charge the same price as before (but with an extra 30%) because they'll pocket that previously taxed money as profit. This is unlikely in a competitive marketplace. While it may happen in monopolies, you have to also remember that you need to compare this with the current system. Nothing is currently stopping a monopoly from raising prices today, so you can't say monopolies can raise prices under the FAIRtax as a reason to be against it.

If an industry is so profitable because its incumbent businesses are screwing you over by keeping the previous total aggregated taxes as profit and then charging the additional sales tax, it will get new entrants looking to undercut them, because everyone else wants a piece of that profit. Those pressures will get those abnormal profits to lower, which means prices will lower. That means prices won't actually go up by 30%. They could go up slightly depending on the industry (as in, not a true 1:1 as the above image tries to describe), but remember... you'll have your whole paycheck to pay for it, not just part of it like today.

And also remember... you won't have to spend time with tax preparation software ever again. “Tax Day” wouldn't exist. There would be no tax returns to file. Pretty good deal.

Do you have other questions about the FAIRtax? You should direct them towards Americans for Fair Taxation. Or the KoopaTV comments section, and Ludwig will see what he can do to help answer them.

Ludwig wrote an article purely dedicated to the FAIRtax back in 2018's Tax Day, though every year has had references to the FAIRtax.

Last year on Tax Day, Ludwig wrote about how the IRS doesn't scale well. Maybe the government could handle the sheer number of documents it receives with a smaller amount of tax-collecting entities?

So all in all the Fairtax sounds pretty...good? Be honest now, do you file those pesky taxes in a timely manner or do you wait for the last minute like everyone else?

ReplyDeleteAs Prince of Koopa Kingdom, I don't pay taxes.

DeleteIf you don't pay taxes, than why should we trust your opinion on this matter? Should we not trust you because you may have not have a complete understanding of taxes, or because you endorsing this would mean that it's more likely to benefit those in positions of great power like yourself?

DeleteOr, (even worse!) people in positions of power who happen to be in royal family's? I don't mind sending some money to Princess Anne if she needs it, but i don't really wanna give my hard earned cash to Harry and Megan. Although, I guess they both are and aren't royals now... it's still a little confusing.

Well, monarchs in some countries DO make tax policy, and some of those nations do very well.

DeleteHere's another benefit of the FAIRtax; there are a whole class of people (tax preparers, accountants, corporate financiers, some legislators) whose entire value is that they have a "complete understanding of taxes" of the American system. With the FAIRtax, it's simple and straight-forward enough where every taxpayer can have a complete understanding of the system.